Regulation of digital properties

Law No. 4 of 2022 Concerning the Regulation of Virtual Assets in the emirate of Dubai aims to protect investors and design the much-warranted international standards for virtual asset (VA) industry governance. Dubai Virtual Assets Regulatory Authority (VARA) was set up to achieve the goals of the above law.

Regulation of Virtual Assets in The UAE

The UAE has established a comprehensive regulatory framework for virtual assets through Cabinet Resolution No. 111 of 2022 Regulating Virtual Assets and the Related Service Providers. This decision forms the legal foundation for organising virtual asset activities across the UAE, enhancing investor protection, and promoting transparency in a rapidly expanding global market. It grants the Securities and Commodities Authority broad powers to supervise, license, and oversee virtual asset service providers, while ensuring strict compliance with anti-money laundering and counter-terrorism financing requirements, as well as implementing the technical and operational standards necessary to safeguard digital transactions. The provisions of this decision apply to all virtual asset activities in the UAE, including within free zones.

To reinforce this framework, the UAE issued Cabinet Resolution No. 99 of 2024 Concerning the List of Violations and Administrative Penalties for Acts Violating the Provisions of Cabinet Resolution No. 111 of 2022, which sets out a detailed list of violations and administrative penalties for non-compliance with the regulations. Additionally, Cabinet Resolution No. 83 of 2025 Regarding Fees for Services Provided to Virtual Asset Service Providers, establishes the applicable fees and charges for licensing and regulatory services provided to virtual asset service providers.

These decisions create an integrated regulatory system that strengthens compliance, enhances governance, and ensures a secure and stable environment for investors, businesses and innovators in the virtual assets sector.Regulation of Virtual Assets in Dubai

Law No. 4 of 2022 (PDF, 250 KB in Arabic) Concerning the Regulation of Virtual Assets in the emirate of Dubai aims to create an advanced legal framework to protect investors and design the much-warranted international standards for virtual asset (VA) industry governance to promote responsible business growth, under prudential regulations. The law is applicable throughout the emirate, including special development zones and free zones, but not Dubai International Financial Centre.

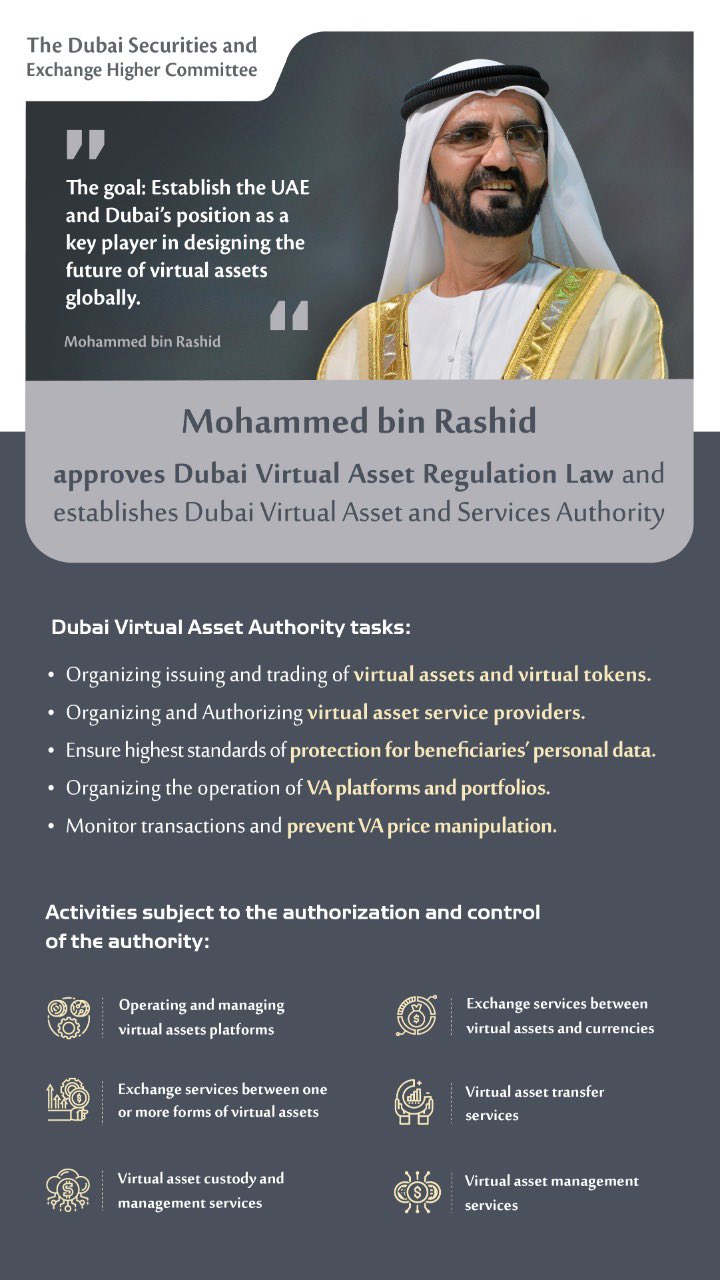

Dubai Virtual Assets Regulatory Authority (VARA)

Dubai Virtual Assets Regulatory Authority (VARA) was set up to achieve the goals of the above law. The authority has a legal personality and financial autonomy and is linked to the Dubai World Trade Centre Authority (DWTCA). VARA will be responsible for licensing and regulating the sector across Dubai’s mainland and the free zone territories (excluding DIFC).

It will provide a full range of services in coordination with Central Bank of the UAE and Securities and Commodities Authority. It is mandated with organising and setting the rules and controls for conducting virtual assets-related activities including management services, clearing and settlement services, in addition to classifying and specifying types of virtual assets.

VARA’s tasks

The following are the tasks of VARA:

- organising issuance and trading of virtual assets and virtual tokens

- organising and authorising virtual asset service providers

- ensuring the highest standards of protection for beneficiaries’ personal data

- organising the operation of virtual assets’ platforms and portfolios

- monitoring transactions and preventing price manipulation of the virtual assets.

VARA’s activities

The following activities are subject to authorisation from VARA:

- operating and managing virtual assets’ platforms services

- exchange services between virtual assets and currencies, whether national or foreign

- exchange services between one or more forms of virtual assets

- virtual assets’ transfer services

- virtual assets’ custody and management services

- services related to the virtual assets’ portfolio

- services related to the offering and trading of virtual tokens.

Read related news coverage on WAM and the website of Dubai Media Office.

Useful links:

- FATF focus on virtual assets - The Financial Action Task Force (FATF)

- Virtual Asset Activities -Abu Dhabi Global Market

- Virtual Assets – Dubai World Trade Centre

Joint Guidance on Combating the Use of Unlicensed Virtual Asset Providers in the United Arab Emirates This document warns the public and Licenced Financial Institutions (LFIs), Designated Non-Financial Businesses and Professions (DNFBPs) and Licenced Virtual Asset Service Providers (VASPs) of the risks of financial crimes, and provides guidance to identify fraudulent dealings and on measures to stay safe.

Updated on:

24 Nov 2025